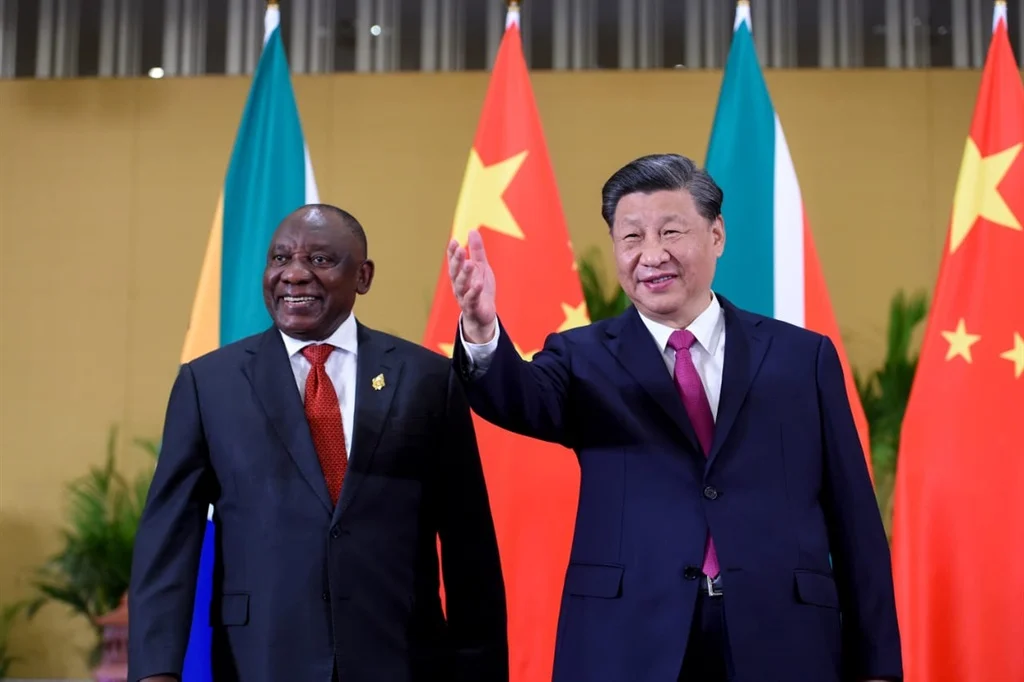

South Africa’s Pivot to China: A Defining Feature of President Ramaphosa’s Legacy

There is growing consensus amongst political economy observers that China-South Africa relations could define President Cyril Ramaphosa’s economic legacy. Building on the massively successful state visit ahead of the Forum on China-Africa Cooperation (FOCAC), President Ramaphosa’s delegations crafted multiple bilateral trade agreements with China, primarily framed under the concept of “Synergising Belt and Road cooperation with South Africa’s National Development Plan.” The alignment of South Africa’s National Development Plan, first introduced in 2012, with China’s decade-old Belt and Road Initiative (BRI) highlights a deeper synergistic connection between the two nations. After all, China is South Africa’s largest trading partner.

At the State visit the two countries agreed to align Align South Africa’s post-COVID-19 Economic Reconstruction and Recovery Plan with the Belt and Road Initiative (BRI). Other areas covered included partnerships to:

- Utilise the China-South Africa Joint Working Group (JWG) and the Joint Economic and Trade Committee (JETC) to further enhance economic and trade relations by improving the existing trade structure.

- Increase market access and boost the export of value-added goods from South Africa, while enhancing new two-way investments and expanding manufacturing bases close to relevant raw material sources to facilitate technology transfer and job creation.

- Organise New Energy Investment Conferences through chambers of commerce associations from both nations,

- and deepen cooperation in traditional sectors such as agriculture, health, medical sciences, infrastructure development, and the Fourth Industrial Revolution (4IR) while supporting South Africa’s coordinated urban and rural development efforts.

Narrowing the Trade Deficit

President Ramaphosa’s second term is expected to solidify his legacy, building on his efforts to revitalise the battered image of the African National Congress and attract tangible investment. While Ramaphosa’s pro-market and neoliberal policies have reassured markets and boosted economic prospects, the Government of National Unity (GNU), stitched together after the 2019 elections, faces significant challenges in translating the anticipated economic growth into meaningful poverty alleviation and social transformation for the broader South African population.

Despite the country’s substantial mineral exports, chiefly to China, many South Africans continue to struggle with daily-lived poverty and under-development. South Africa’s massive coal reserves still face debilitating funding bottlenecks: China withdrew its support for South Africa’s Musina-Makhado Special Economic Zone and Zimbabwe’s $3 billion Sengwa coal project in 2021 after President Xi Jinping announced that China would no longer back the construction of coal power plants abroad.

Bid for Smart Cities and Industrialisation through New Energy Minerals

The push by the Ramaphosa administration to align the NDP with the BRI underscores the commitment to revive South Africa’s ailing mining and downstream industrialisation sectors and create jobs through beneficiation and value-addition. This is exemplified by the proposed New Energy Conferences, potentially laying the groundwork for his envisioned smart cities. These initiatives take time. But while Ramaphosa’s vision may only materialise in the latter part of his presidency, history will be kind to him for having that vision to lift the economy from intensive care.

The Ramaphosa administration’s ambitious plans for Nkosi City near Kruger National Park, the African Coastal Smart City in the Eastern Cape, and Lanseria Smart City in Gauteng can only come to fruition with the support of BRI financing and partnerships.

These proposed South African developments could take inspiration from successful BRI projects in other African countries like:

- Kenya’s Standard Gauge Railway (SGR) project that connects Nairobi to the port city of Mombasa which came a hefty $5billion,

- The $738million Maputo-Katembe Suspension Bridge in Mozambique

- Accelerated investments in renewable energy projects in the Lithium, Copper, and Cobalt value-adding projects in Namibia, Botswana, Zimbabwe, and DRC,

- And further north the $4.9 billion construction of the Mambilla hydroelectric plant in Nigeria.

BRI projects and investments have been implemented in numerous countries across Asia, Africa, Europe, and even South America. The largest of BRI projects to date is the China-Pakistan Economic Corridor (CPEC), with $60 billion already invested by China.

Jittery Allies and Watchful Eyes

President Ramaphosa has been at pains to reassure comrades within his party and nervous South Africans that the country’s bromance with China will not lead to a resurgence of neocolonialism, despite concerns over multilateral loans and debt traps. The experiences of Zambia and Kenya, which have struggled with repayment of BRI liabilities, serve as cautionary tales. While Ramaphosa’s agreements are tied to the successful implementation of the Africa Continental Free Trade Agreement(AfCFTA), each of the African states that besieged Beijing over the FOCAC week will have its own unique wounds to lick. As a result, economic progress will likely favour those with a bold appetite and stronger economic fundamentals, perpetuating uneven development trajectories across the continent.

As the Ramaphosa administration enhances its focus on strengthening relations with China, political observers are keen to understand how this partnership will evolve in the post-Ramaphosa era and whether it can withstand future tensions within the Government of National Unity while mitigating sovereign risks. The government would be wary that the upfront pressing requirement is to approach the partnership with careful planning and robust local collaborations between public and private stakeholders. But above all, maintaining the goodwill of South Africans is vital to ensure that the benefits of this collaboration outweigh any potential risks.

Editor: Fulufhelo Lloyd Nedohe|ESGFrontiers