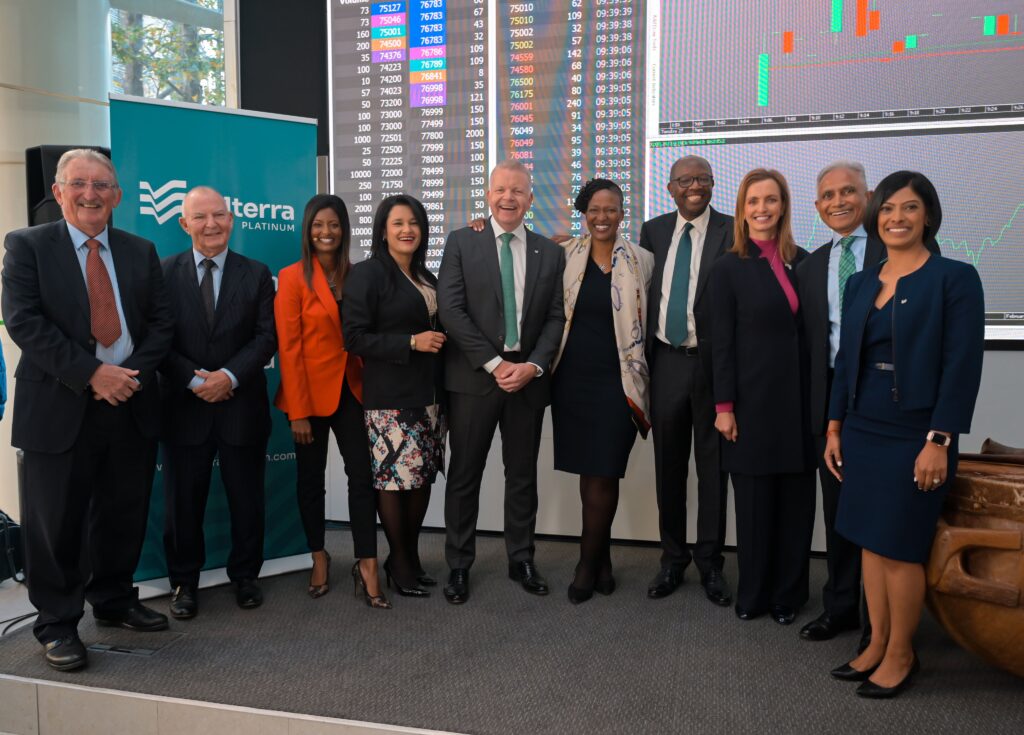

Last week, Anglo American’s platinum operations officially began trading as Valterra Platinum on the Johannesburg Stock Exchange (JSE) under the ticker ‘VAL’, marking a pivotal moment in the mining giant’s strategic overhaul. The move, followed by a secondary listing on the London Stock Exchange (LSE) , closely mirrors a similar portfolio simplification undertaken by fellow global diversified miner, BHP, with its South32 demerger almost a decade ago.

The spin-off of Valterra, comprising Anglo American’s extensive platinum group metals (PGM) assets in South Africa, is a direct consequence of Anglo’s accelerated strategy to streamline its portfolio. The company aims to sharpen its focus on “future-enabling” commodities like copper and premium iron ore, a strategy intensified by recent takeover interest from BHP itself. Valterra CEO Craig Miller has emphasised the company’s commitment to leveraging its South African PGM resource base, highlighting the nation’s significant role in global PGM supply.

It’s the BHP Billiton Playbook: Unbundling for Strategic Focus

This strategic unbundling draws striking parallels to BHP’s 2015 creation of South32. At the time, BHP sought to divest a suite of “non-core” diversified assets – ranging from Australian and South African coal to aluminium and manganese – to focus on its major iron ore, copper, and petroleum divisions. South32 subsequently secured primary listing on the ASX, with crucial secondary listings on both the JSE and LSE, reflecting its global asset base and shareholder spread.

For South Africa, these demergers hold particular significance. Both Valterra and South32 maintain substantial operational footprints and JSE listings, cementing their ties to the local economy and investment landscape. South32, for instance, holds significant manganese operations in the Northern Cape (Hotazel Manganese Mines), and notably, Anglo American still retains a 40% stake in the Samancor Manganese Joint Venture, which South32 manages. This intertwined history underscores the long-term ripple effects of such corporate restructurings on the South African mining sector.

The demergers by Anglo American and BHP reflect a broader industry trend where mining majors shed complex, multi-commodity portfolios in favour of more focused, agile entities. This strategic shift aims to unlock shareholder value by allowing specialised management teams to optimise assets within defined commodity sectors, while also positioning the parent companies for future growth in what they deem to be more strategic commodities. The success of Valterra will now be keenly watched as it navigates the PGM market as an independent, South African-rooted powerhouse.

Editorial: Lloyd Nedohe_ on X| Email: info@esgfrontiers.co.za