From Mozambique Coal Catastrophe to De Beers Bid: Michael O’Keeffe’s Controversial Comeback in the Diamond Sector. Opinion by Lloyd Nedohe

Following the recent successful demerger and listing of its platinum business, Anglo American Platinum (Amplats), in London and Johannesburg, Anglo American has now sharpened its focus on the sale of its diamond unit, De Beers. This comes as the diamond market faces one of its deepest crises, leading to a recent write-down of De Beers’ value to $4.1 billion.

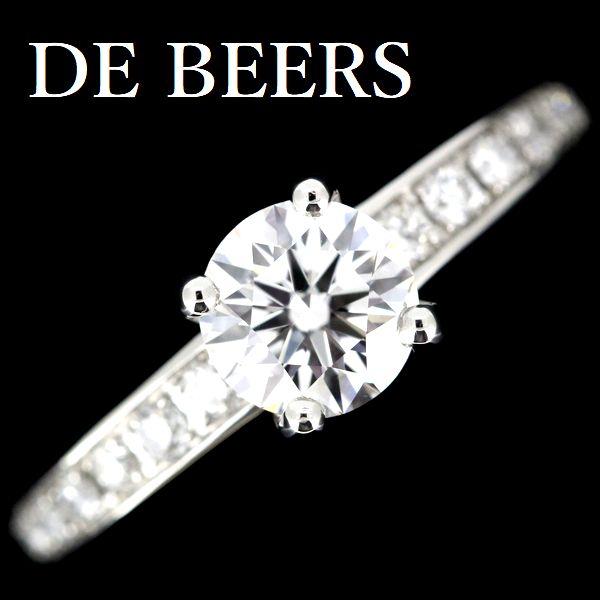

De Beers, the world’s largest diamond producer by value, holds a storied history, founded in 1888 in South Africa by British mining magnate Cecil Rhodes. The company was partially owned by the Oppenheimer dynasty, which also founded Anglo American, until the family sold their 40% stake to Anglo American itself in 2012. However, the diamond sector, and De Beers in particular, has faced significant challenges in the past three years due to declining sales, a sluggish global economy, and the rising threat of lab-created diamond alternatives.

Diamond Assets Spark Competition Among Suitors

Suitor interest for this iconic diamond miner includes two former chief executives: Bruce Cleaver, currently chairperson of emerald miner Gemfields Group and CEO of De Beers until 2023, and Gareth Penny, who ran De Beers when the billionaire Oppenheimer family still owned a stake and is credited with leading the company through the global financial crisis. Adding to this intriguing lineup, Australian mining veteran Michael O’Keeffe has also emerged among potential buyers. His interest marks a notable return to the Southern African mining landscape, a decade after his last major venture left a multi-billion-dollar hole in a global mining giant’s balance sheet.

Can Michael O’Keeffe Rewrite His Mining Script?

O’Keeffe is widely known for orchestrating the sale of Riversdale Mining to Rio Tinto Group for a staggering $3.7 billion in 2011. Riversdale’s primary assets were vast coal deposits in Mozambique. What followed was one of the most disastrous acquisitions in recent mining history. Rio Tinto rapidly discovered that the coal quality and quantity were overhyped, and crucial logistics proved unfeasible. Less than two years after the acquisition, Rio Tinto was forced to announce a colossal $3 billion write-down, followed by further impairments, effectively wiping out the purchase price.

The fallout led to the resignation of Rio Tinto’s then-CEO, Tom Albanese, and a subsequent $28 million settlement with the SEC over fraud charges related to asset valuation. Rio Tinto’s Riversdale baggage lingered, with the Zululand Anthracite Colliery sale dragging on for four years before Menar Holding finally acquired their 74% stake in 2016.

While Rio Tinto bore the brunt of the financial catastrophe, O’Keeffe, as a significant Riversdale shareholder, personally pocketed a substantial sum from the sale, estimated at around $95 million, along with lucrative compensation packages. His exit from Riversdale was financially successful, despite the asset’s subsequent implosion for the buyer.

From Riversdale to Diamonds: Can O’Keeffe Turn His Luck Around?

Now, O’Keeffe is back. This time, he’s part of a consortium eyeing De Beers, a crown jewel in Anglo American’s portfolio, as the diversified miner sheds assets to fend off takeover attempts. His current role as Chairman of Burgundy Diamond Mines, an Australia-based company operating Canada’s Ekati mine, demonstrates his continued deep involvement in the diamond sector.

South African mining minister Gwede Mantashe has publicly supported Anglo’s current restructuring plan over a BHP-driven split, stating to the Financial Times , “I am happy with the rejection of the BHP deal and I hope it will continue, then Anglo can restructure itself to optimize value for shareholders.” The minister’s backing is crucial as it reflects the government’s stance on the future of a major player in the country’s mining industry, especially as the sector faces job losses.

O’Keeffe’s re-emergence in such a prominent Southern African deal adds a compelling narrative. His track record raises questions about the due diligence and valuation processes that will underpin any future acquisition. As Anglo American navigates this crucial sale, all eyes will be on the players involved, not least the mining veteran who once exited a Southern African coal deal with a substantial gain, leaving others to count the cost.

Editorial: Lloyd Nedohe E: info@esgfrontiers.co.za