A global decline in lithium battery pack prices, as recently announced by BloombergNEF, could make electric vehicles (EVs) more affordable in emerging markets like South Africa. Despite struggling to attract investment from battery mega factories, South Africa is poised for a significant shift towards clean mobility. With over 13 million internal combustion engine (ICE) vehicles on its roads, the country is eager to transition to new energy vehicles (NEVs).

Recent engagements between President Ramaphosa and key industry players, including China’s BYD and Tesla’s Elon Musk, have sparked optimism for a new era of sustainable transport in 2025. The anticipated decrease in global battery prices will drive domestic demand and propel South Africa’s EV market forward.

South Africa plans to transition its significant automotive industry from primarily producing internal combustion engine (ICE) vehicles to a dual platform that includes the production of electric vehicles (EVs).

National Treasury highlighted in its explanatory memorandum of the Taxation Laws Amendment Bill (TLAB) that the transition is driven by pressing environmental concerns and the need for countries to fulfill their national emission reduction commitments under the Paris Agreement. The draft TLAB includes provisions that implement an investment allowance of R500 million for the 2026/27 tax year.

Decline in batteries relieves demand bottlenecks

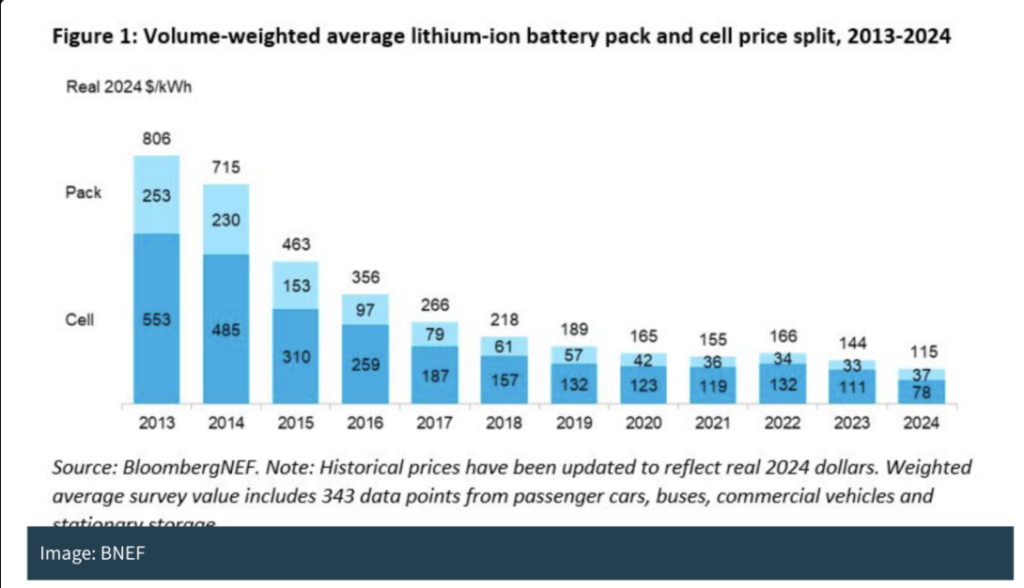

Global lithium-ion battery pack prices have reached a historic low in 2024, according to a recent report by BloombergNEF (BNEF). The average price has fallen by 20% to $115 per kilowatt-hour (kWh), marking the largest annual decline since 2017. This significant drop has pushed prices for electric vehicle (EV) batteries below the $100 per kWh threshold for the first time, with specific figures indicating prices around $97 per kWh for battery electric vehicles (BEVs) .

Key Drivers of Price Decline

Several factors have contributed to this dramatic decrease in battery prices:

- Manufacturing Overcapacity: The global battery manufacturing capacity has soared to 3.1 terawatt-hours, which is more than 2.5 times the current demand for lithium-ion batteries in 2024 .

- Economies of Scale: Increased production efficiency and scale have allowed manufacturers to cut costs significantly .

- Low Raw Material Prices: A reduction in the costs of metals and components used in battery production has further facilitated price drops .

- Shift to Cheaper Battery Technologies: The growing adoption of lithium iron phosphate (LFP) batteries, which are less expensive than traditional nickel manganese cobalt (NMC) batteries, has also played a crucial role in lowering overall costs .

Regional Price Variations

The price of lithium-ion battery packs varies significantly by region. In China, the average price is reported at approximately $94 per kWh, while prices in the U.S. and Europe are higher—by about 31% and 48%, respectively. This disparity reflects different market dynamics, production costs, and volumes across these regions .

A recent study by Goldman Sachs Research indicates that electric vehicle battery prices are projected to decrease by nearly 50% by 2026. The report highlights that the global average battery price fell from $153 per kilowatt-hour (kWh) in 2022 to $149 in 2023, and it is anticipated that prices could drop to around $80/kWh by 2026, representing a significant reduction.

The EV White Paper and Dual Automotive Future by 2035

Such a decline in battery prices would enhance the competitiveness of electric vehicles (EVs) in South Africa, particularly as the government’s tax incentives position new energy vehicles as a viable alternative to the entrenched internal combustion engine (ICE) market. The provisions in South Africa’s National Treasury, outlined in the draft Taxation Laws Amendment Bill (TLAB), allow car manufacturers to claim 150% of their expenditures on new production capacity for electric and hydrogen-powered vehicles.

South Africa’s Electric Vehicle (EV) White Paper, launched in December 2023 after “extensive international and domestic consultations” outlines a strategy to transition the country’s automotive industry from primarily producing internal combustion engine (ICE) vehicles to a dual platform that includes both EVs and ICE vehicles by 2035. The White Paper indicates that production of EVs in South Africa could commence as early as 2026, based on engagements between the Department of Trade, Industry, and Competition (dtic) and various original equipment manufacturers (OEMs).

Future Outlook for Battery Prices

Looking ahead, BNEF anticipates that battery pack prices may continue to decline, with an expected further drop of about $3 per kWh in 2025. The ongoing competition among manufacturers, particularly in China, along with advancements in technology and production processes, suggests that these trends could persist in the near future .

China is by far the world’s largest player in battery production. By 2030, Chinese manufacturers like CATL and BYD are expected to dominate nearly 70% of global battery capacity. China’s influence spans the entire supply chain—from mining raw materials to assembling batteries and manufacturing electric vehicles.

Evelina Stoikou, head of BNEF’s battery technology team, noted that the current price drop indicates that margins for battery manufacturers are being squeezed as smaller companies face pressure to lower cell prices to maintain market share. As the industry evolves and adapts to these changes, the path toward greater affordability for electric vehicles seems increasingly viable.

Editorial: ESGFrontiers @lloydnedohe_ on X