In May 2024, just weeks before the pivotal elections that led to the establishment of the Government of National Unity, President Cyril Ramaphosa highlighted the achievements of South Africa’s automotive sector in his weekly column. He noted that the industry celebrated a significant milestone with the production of its six millionth vehicle, alongside reaching an impressive figure of 400,000 vehicles manufactured for export. Additionally, foreign direct investment (FDI) inflows into South Africa reached R96.5 billion, representing 1.4% of the country’s gross domestic product (GDP), with the manufacturing sector attracting the largest portion of this investment, followed by mining and financial services.

Weak demand for Platinum creates jitters

However, 2024 has witnessed significant turmoil in the platinum group metals (PGMs) sector. Earlier this year, the Minerals Council of South Africa warned that the South African platinum industry could lose as many as 7,000 jobs as companies seek to cut costs, with some of the largest operators considering restructuring unprofitable production lines. This looming jobs crisis in a vital segment of the formal economy highlighted the African National Congress’s (ANC) ongoing struggle to address the persistently high unemployment rates in the country, analysts warned.

While analysts maintain that global demand for PGMs should remain robust, bolstered by investments in industrial applications, concerns have been raised regarding declining demand from the automotive sector. This downturn is largely attributed to a decrease in diesel vehicle production as key markets gradually shift towards electric vehicles.

Rupen Raithatha, Market Research Director at Johnson Matthey, commented: “Although platinum, palladium, and rhodium will all be in deficit this year, the markets remain highly liquid. Automotive and industrial users bought more metal than they needed during 2020-2022 to mitigate price and supply risks. Since then, consumers have been using up excess PGM inventory, and some have even sold metal back to the market. As a result, palladium and rhodium prices fell sharply during 2023 and have been relatively stable so far this year.”

TESLA, ANGLO, and BHP unite to seek SA policy assurances

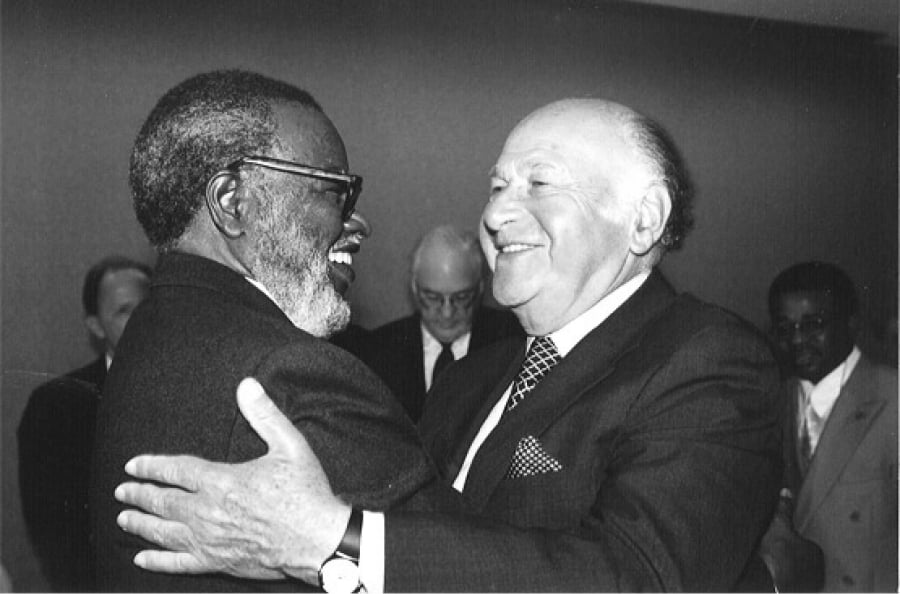

During a closed-door meeting in New York on Monday, President Ramaphosa and South African-born entrepreneur Elon Musk met to discuss key issues regarding minerals policy and regulation. The discussion likely centred on addressing Musk’s concerns and exploring opportunities for investment in the country’s minerals sector.

As Tesla continues to prioritise environmental, social, and governance (ESG) considerations, the company is increasingly focused on manganese as a crucial component in its battery technology. By reducing reliance on cobalt, Tesla aims to mitigate associated ESG risks, including artisanal mining concerns, child labour allegations, and environmental degradation. Musk had previously been hesitant to invest in South Africa, but this meeting suggests he may be reconsidering.

Confronted with the global PGM crisis in traditional Asian markets and the need for diversification, major mining companies such as Anglo-American and BHP—leading exporters of manganese from South Africa—along with Musk’s Tesla, a frontrunner in the electric vehicle market, sought direct assurances that policies promoting beneficiation, particularly for critical minerals, would not upend supply chain sustainability.

And this is the point where the BCIU demonstrated its strategic value in facilitating global backchannel communications.

Enter the BCIU

According to its website, The Business Council for International Understanding (BCIU) offers tailored commercial diplomacy services to governments and leading organisations, including Fortune 100 companies, global investors, and multilateral institutions.

Established in 1955 during the Eisenhower administration, BCIU has focused on fostering international understanding and addressing complex global challenges. Operating behind the scenes at significant global events, BCIU seized the opportunity presented by the 79th Session of the United Nations General Assembly (UNGA) and its high-level week to convey investor concerns to the South African delegation.

With its inherent complexities and uncertainties, the nexus of mining and EV value chains is precisely the domain they relish. And just as in years gone by, the UNGA sidelines are a perfect stage.

6 months to the UN Critical Minerals Recommendations

In the first week of September 2024, United Nations Secretary-General António Guterres released a report from the Panel on Critical Energy Transition Minerals. The Panel, established in April 2024, was co-chaired by South African Ambassador Nozipho Joyce Mxakato-Diseko, a formidable diplomat who famously led a group of 130 nations against the draft United Nations climate accord in 2015, labelling it as a form of “apartheid” against developing countries ahead of the Paris Agreement.

Guterres’ position paper calls for collaborative efforts among governments, industries, and civil society to achieve a just energy transition. By adhering to the recommended principles, stakeholders can leverage critical minerals not only to propel the clean energy revolution but also to promote sustainable development that benefits all communities involved.

In the BCIU session, in the presence of the UN Panel, and surrounded by powerful Washington minerals lobbyists and capital, Ramaphosa endorsed the paper, stating that “South Africa strongly endorses the UN Secretary-General’s position paper on Critical Energy Transition Minerals, where he highlights the importance of beneficiation, benefit sharing, local value addition, and economic diversification. What will be critical is to ensure that this progress does not leave Africa behind. The extraction of critical minerals must not perpetuate colonial-era patterns of exploitation of the continent’s rich resources.”

Ramaphosa is acutely attuned to the hazards of the mining industry. A former trade unionist himself, it was not lost on him that the mining firms are notoriously some of the worst perpetrators of human rights violations: exploitation of workers, environmental degradation, and frequent community displacements are the hallmarks of the sector tensions. It can’t be net zero at all costs.

AfCTA EV and battery map emerging

It is essential to note that South Africa’s EV market remains small. After his visit to China and now to the US, President Ramaphosa will take the message to his African Continental Free Trade Agreement (AfCFTA) counterparties on the continent. The AfCFTA connects over 1.3 billion people across 54 countries, creating a single, tariff-free market. This expanded access allows Tesla to reach a broader customer base for electric vehicles (EVs) and related products, enhancing its sales potential across the continent.

Opinion by Fulufhelo Lloyd Nedohe | Editor: ESGFrontiers| @lloydnedohe_ on X